Funding your own retirement is intimidating. Many of us feel unprepared for the task of managing our money, and that makes the job doubly difficult. And yet, for a great many people, there’s no choice.

Like it or not, our ability to live comfortably in old age is up to us. Our futures depend on what we do today and tomorrow.

If you want to dive deeply into it, retirement saving and investing can be complex. But most of us aren’t interested in becoming experts. For a simple, manageable approach, check out these five steps.

Step 1: Use your age to decide what to put in stocks

Over time, stocks have produced higher returns as an investment — although, as financial product ads warn, past performance doesn’t predict future results. Retirement savers often invest in stocks by buying stock mutual funds.

Investors might need a rule of thumb to decide how much of their portfolio to put in stocks. Money Talks News founder Stacy Johnson favors this formula:

- Subtract your age from 100.

- Use the remainder as a percentage to invest in stocks.

How it works: If you’re 45, subtract 45 from 100, which leaves 55. So, invest 55% of your portfolio in stocks.

Some experts think the mix should change now that Americans are facing longer retirements. CNN Money’s Ultimate Guide to Retirement says:

“[W]ith Americans living longer and longer, many financial planners are now recommending that the rule should be closer to 110 or 120 minus your age. That’s because if you need to make your money last longer, you’ll need the extra growth that stocks can provide.”

So, if you’re 45, subtract 45 from 110, leaving 65. Invest 65% of your portfolio in stocks. Or, subtract 45 from 120, leaving 75, and put 75% of your portfolio in stocks.

You get the idea. The only trick is to choose the equation that you think is most closely aligned with your risk tolerance, and your health and family history — in other words, your life expectancy.

Step 2: Find your tolerance for risk

Stocks offer a better chance of growing your money, but they also involve more risk. In general, the stock market has climbed since the end of the recession. But don’t let that make you complacent. Investing can be a gut-churning ride.

Here’s the puzzle that retirement savers face: If you keep all of your money in cash or low-risk investments, you’ll earn practically nothing. You may even lose money to inflation. More risk can mean a chance for higher returns.

Understanding your tolerance for risk helps you decide how to invest and lets you sleep well at night. To explore your investment risk tolerance, use a risk assessment quiz — you can find free ones online.

The proportion of your savings that you put in stocks is up to you and your comfort level with risk. Not everyone uses the formulas above. They’re just a place to start. For some investors, putting half or more of your savings in stocks feels too risky. If that’s you, don’t do it.

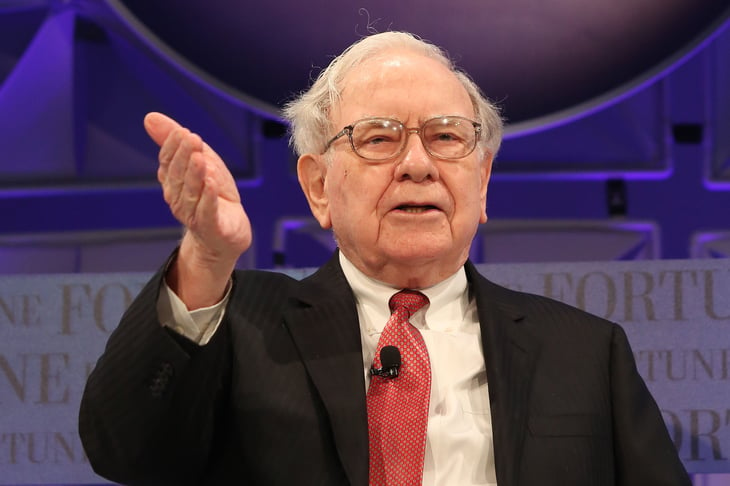

Step 3: Listen to Warren Buffett — pick a stock fund

Many investors prefer a simple way to invest: They buy shares of index funds. Managed by computer, these mimic the performance of a particular group of stocks or bonds. The Vanguard 500 Index Fund, for example, mimics the performance of Standard & Poor’s 500 stock index.

Index funds are cheaper compared with managed funds (which are managed by human experts). Even better, the track record of index funds is often at least as good as the performance of actively managed funds.

Berkshire Hathaway founder and CEO Warren Buffett is famously bullish on index fund investing. In 2008, he placed a $ 1 million bet that, including fees and other costs, an S&P 500 index fund would beat the hedge fund’s returns over 10 years. Buffett’s index fund beat the hedge fund yearly from 2009 through 2014, Investopedia says, although it took the index fund four years to deliver a bigger cumulative return. The hedge fund manager conceded defeat before the 10 years were up.

Step 4: Diversify

A carefully chosen diverse set of investments helps cushion you against losses from stocks. The U.S. Securities and Exchange Commission says:

“The practice of spreading money among different investments to reduce risk is known as diversification. By picking the right group of investments, you may be able to limit your losses and reduce the fluctuations of investment returns without sacrificing too much potential gain.”

Pick your stock market investments first. For the remainder of your money, Money Talks News founder Stacy Johnson suggests dividing it in half: Put one-half into a low-cost intermediate bond fund and the rest into a money market deposit account or other insured fund.

Bonds pay considerably lower returns than stocks over time, but they can be safer. Investors traditionally purchase bonds to keep a portion of their money in a safe haven in case stock prices fall. Bonds historically increase in value when stocks fall.

Bank deposits and money market deposit accounts are insured by the federal government, usually for up to $ 250,000 in losses. Money market mutual funds — which contain instruments like government bonds, Treasury bills and certificates of deposit — are not federally insured. For a full rundown of which accounts are government-insured, and which are not, check this Federal Deposit Insurance Corp. link.

Step 5: Consider your investment time horizon

The proportion of money you put in stocks also should depend on how soon you’ll need your cash. That’s why the rules of thumb above take your age into account. You can tolerate more risk if you know you have 20 years to make up any losses. If you’re planning to retire and will need money within five years, you’re better off limiting your risk.

Disclosure: The information you read here is always objective. However, we sometimes receive compensation when you click links within our stories.