At this point, higher taxes seem to be more a question of when than if.

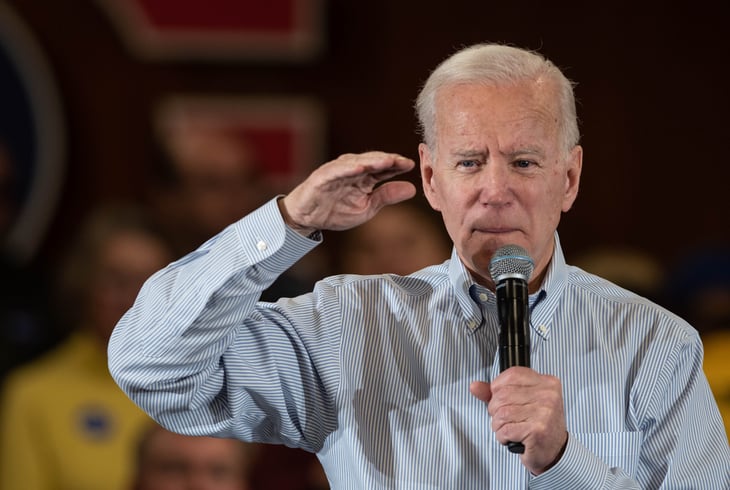

Tax increases for the wealthy and corporations were a central part of President Joe Biden’s campaign, and he confirmed in a recent interview with ABC News that such tax hikes remain on his presidential agenda.

Plus, some members of Congress recently have introduced their own plans to raise taxes.

So, following is a look at some of the groups of people and types of entities that are likely to see their taxes rise under Biden. They cover a wider range of incomes than you may realize.

1. Some gig workers

This is the only tax change in this article that has already happened. The American Rescue Plan Act of 2021, which Biden signed into law on March 11, requires online “gig economy” platforms — like Uber, DoorDash, Airbnb, Etsy and TaskRabbit — to report their payments to gig workers to the IRS if a worker earns at least $ 600. Previously, that threshold was $ 20,000.

Technically, this isn’t a tax increase because such gig workers generally should have been reporting all of their income to the IRS all along. But this change likely will have the same effect as a tax hike: more revenue for the federal government. Roll Call reports that it’s expected to generate an estimated $ 8.4 billion in extra tax revenue through the 2031 fiscal year.

2. Anyone earning more than $ 400,000

The first sentence Biden uttered after telling ABC News on March 16 that “yes,” he will raise taxes was:

“Anybody making more than $ 400,000 will see a small to a significant tax increase.”

The president did not give any further details about the type or degree of tax increases such folks can expect, but his official campaign platform provides some insight. It called for “raising payroll taxes for workers with more than $ 400,000 in earnings,” as we detailed last year in “5 Ways Joe Biden Wants Social Security to Change.”

Payroll taxes, also known as FICA taxes, include the Social Security and Medicare taxes that are withheld from employees’ paychecks. Currently, there is an earnings cap on Social Security taxes, however — $ 142,800 for 2021. That means workers who earn more than $ 142,800 this year will not owe Social Security taxes on their earnings above that threshold.

Another possibility for folks earning more than $ 400,000 is an actual income tax hike, according to still-private plans of the Biden administration that recently were leaked to Bloomberg.

3. Corporations

Biden also mentioned raising the corporate tax rate to 28% in the ABC interview. That would partially undo a key change made by the Tax Cuts and Jobs Act of 2017, which then-President Donald Trump signed into law: The 2017 overhaul of the federal tax code reduced the corporate tax rate from a maximum of 35% to a flat 21%.

Biden’s official campaign platform also called for “a 28% corporate tax rate.”

4. Individuals in the highest income bracket

The Tax Cuts and Jobs Act also temporarily lowered the tax rate for individuals in the highest income tax bracket from 39.6% to 37%. In his ABC interview, Biden mentioned raising this rate, citing both 39.8% and 39.6%.

During his presidential campaign, Biden called for “raising the top individual income rate back to 39.6%,” as we detailed in “7 Ways Your Taxes Could Change Under Biden.”

As of the 2020 tax year — the one for which returns are due this spring — the top individual tax rate applies to people whose taxable income is more than:

- $ 518,400 if their tax-filing status is single or head of household

- $ 622,050 if their status is married filing jointly or surviving spouse

5. People who inherit capital

David Kamin, deputy director of the White House’s National Economic Council, recently told Bloomberg that the tax changes the administration is discussing include eliminating what’s known as the “step-up in basis” for estates.

The step-up in basis applies to capital assets like stocks, bonds and real estate that are inherited. As the nonprofit Tax Foundation explains it:

“Step-up in basis reduces capital gains tax liability on property passed to an heir by excluding any appreciation in the property’s value that occurred during the decedent’s lifetime from taxation.”

6. Estates

Estate planners are bracing for the possibility that the U.S. Treasury Department could revive tax-increasing regulatory efforts, Financial Planning reports:

“Some of the regulations, either withdrawn or made a low priority under Trump, would restrict access to tools for reducing estate tax bills, in effect acting as a tax increase without the hurdle of passing tax legislation in an evenly divided Senate.”

Additionally, the White House is eying an expansion of the estate tax, according to the Bloomberg report on the administration’s still-private tax plans.

7. Millionaires with capital gains

Increasing the capital-gains tax rate for individuals earning at least $ 1 million per year reportedly is part of the Biden administration’s tax plans as well, according to Bloomberg. Capital gains are earnings from the sale of capital assets like stocks and bonds.

While no further specifics have been made public yet, Biden’s official campaign platform provides some insight: It called for having such individuals pay the same rate on capital gains as they pay on ordinary income like wages.

Net capital gains are taxed at different rates than ordinary income. Currently, the highest tax rate for net capital gains is 15% for most individuals, but can push up to 20% or even 28% in some situations. The highest ordinary income tax rate is 37%.

8. Pass-through businesses

Major corporations are not the only type of business entity that could see higher taxes under Biden. According to Bloomberg, the administration’s still-private tax plans include “paring back tax preferences” for what are known as pass-through businesses, although it’s unclear exactly what that would entail.

According to the Tax Foundation, pass-throughs are the most common type of business in the U.S. They include S corporations and limited-liability companies. They also include sole proprietorships, a business structure self-employed folks often use.

Currently, the corporate tax rate of 21% does not apply to pass-through businesses. They pay on income as individuals do, which currently means rates as high as 37%. But Trump’s Tax Cuts and Jobs Act created a temporary tax break for pass-throughs, allowing individuals to deduct up to 20% of their business income on their taxes.

9. Stock, bond and derivative investors

It’s not Biden’s proposal, but if the Wall Street Tax Act becomes law, it will have the effect of increasing taxes during Biden’s term. The bill, unveiled in both the Senate and the House in March, would create a 0.1% tax on every sale of stocks, bonds and derivatives.

Sen. Brian Schatz (D-Hawaii) described the bill as an effort to discourage high-volume speculative trading, but it does not distinguish between types of traders. The extra 0.1% tax generally applies to any buyer or seller in the U.S.

10. ‘Ultra-millionaires’ and billionaires

Another recent congressional effort to increase taxes is the Ultra-Millionaire Tax Act, which was introduced on March 1 by Sen. Elizabeth Warren (D-Massachusetts) and Reps. Pramila Jayapal (D-Washington) and Brendan Boyle (D-Pennsylvania).

According to Warren, the bill would levy a:

- 2% annual tax on the net worth of households and trusts between $ 50 million and $ 1 billion

- 3% annual tax on the net worth of households and trusts of more than $ 1 billion

Disclosure: The information you read here is always objective. However, we sometimes receive compensation when you click links within our stories.