Money Talks News has partnered with CardRatings for our coverage of credit card products. Money Talks News and CardRatings may receive a commission from card issuers.

Smartly used credit cards serve a variety of needs. They help with managing older debt, bridging blips in cash flow and building credit, and they provide benefits, savings and rewards.

As we approach the holiday shopping season, a variety of new and recent credit card offers can help in each of these areas. Here’s a quick look at the top cards available right now.

Best cash-back card: Blue Cash Preferred from American Express

Nothing beats a little bit of extra cash in your pocket for the holidays, and the Blue Cash Preferred Card is perfect for that.

Why we like it: The Blue Cash Preferred Card offers a very strong 6% cash back on the first $ 6,000 per year in supermarket purchases and 3% cash back at gas stations in the U.S. Plus, for a limited time (offer available until Dec. 10, 2020) you also earn a $ 300 statement credit after you spend $ 3,000 with the card within the first six months.

What to know:

- 6% cash back on up to $ 6,000 at U.S. supermarkets per year, and 1% cash back after that amount

- 6% cash back on certain U.S. streaming subscription services

- 3% cash back on transit including at U.S. gas stations and for taxi or rideshare service

- 1% cash back on other purchases

- 0% introductory APR on purchases for 12 months

- $ 95 annual fee, after a limited time (until Dec. 10, 2020) introductory offer of $ 0 for the first year

Note: Cash back is redeemed as statement credits.

Best overall card bonuses: Chase Sapphire Reserve

If you simply want the card with the best benefits, regardless of annual fee, this is your pick.

Why we like it: The Chase Sapphire Reserve card offers a sign-up bonus of 50,000 Ultimate Rewards points after you spend $ 4,000 with the card within the first three months. Redeeming those points for travel through the Chase website adds 50% to their value, for a bonus worth $ 750.

What to know:

- Get 50,000 bonus Ultimate Rewards points after spending $ 4,000 on purchases in the first three months from account opening.

- Earn 3 points per $ 1 spent on travel and dining.

- Earn 1 point per $ 1 spent on everything else.

- $ 300 annual travel credit

- A free year of Lyft Pink membership

- Complimentary DashPass delivery subscription

- Global Entry or TSA Pre-check application reimbursement up to $ 100

- $ 550 annual fee

Note: The annual fee looks high, but is offset by the $ 300 annual travel credit and other card benefits, including food delivery and rideshare services and airport lounge access.

Best card for travel: Capital One® Venture® Rewards Credit Card

The pandemic may have slowed down travel and postponed your plans, but you can still think ahead and use your spending to rack up future travel with the Capital One Venture.

Why we like it: An early spending bonus offer of 50,000 miles when you spend $ 3,000 within the first three months is a good deal, and if you spend an additional $ 17,000 (for a total of $ 20,000) within the first year from opening the account, you’ll end up with a total of 100,000 bonus miles worth at least $ 1,000 in travel. You can claim either or both of these offers.

What to know:

- Earn 2 miles per dollar on every purchase.

- Get a $ 100 credit on Global Entry or TSA Pre-check.

- Extended warranty protection

- Travel accident insurance

- No foreign transaction fee

- $ 95 annual fee

Note: This card has a $ 95 annual fee. The Capital One® VentureOne® Rewards Credit Card does not, but doesn’t have the same early spending bonus offers and offers a lower rate of return.

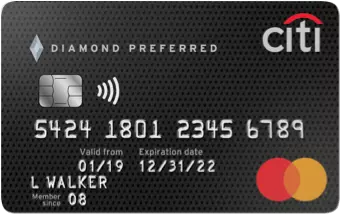

Best no-interest card offer: Citi Diamond Preferred

If you’re dealing with old debt heading into the holiday season, this card can help you manage it and avoid racking up more.

Why we like it: The Citi Diamond Preferred card is a good choice for people transferring a balance, thanks to the introductory 0% APR on both balance transfers and new purchases for the first 18 months.

What to know:

- 0% introductory APR on balance transfers for 18 months, with a balance transfer fee of $ 5 or 3%, whichever is higher

- 0% introductory APR on new purchases for 18 months

- Free access to your FICO Score

- No annual fee

Note: This card has a 3% foreign transaction fee, so plan accordingly for international travel.

Click here for more details on these cards and to compare them with other offers.

Disclosure: The information you read here is always objective. However, we sometimes receive compensation when you click links within our stories.